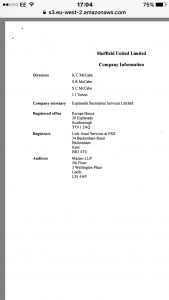

Since: (1) SUL at this stage still technically owns 50% of the shares of Blades Leisure Limited (the 100% owner of SUFC), all of which shares SUL must (under court order) sell to UTB for £5 Million, per KM's irrevocable offer of 12/17; and (2) SUL owns most of the real estate to be acquired by SUFC for +/- £45 Million (my estimate) per the original ISA and associated property sale option contracts; one might surmise that SUL shares have value North of zero. By how much, I have no idea, as there are lots of variables not known to me. It goes without saying, however, that at a time like this SUL creditors and minority shareholders will likely be paying close attention and doing whatever they can to ensure that the +/- £50 Million in proceeds from pending SUL asset sales are handled in a way that takes account of their rights and interests, especially since the assets being sold may represent all or substantially all of the remaining assets of SUL.